Swiss GRC Blog

Current blog and technical articles about Governance, Risk & Compliance

Most read

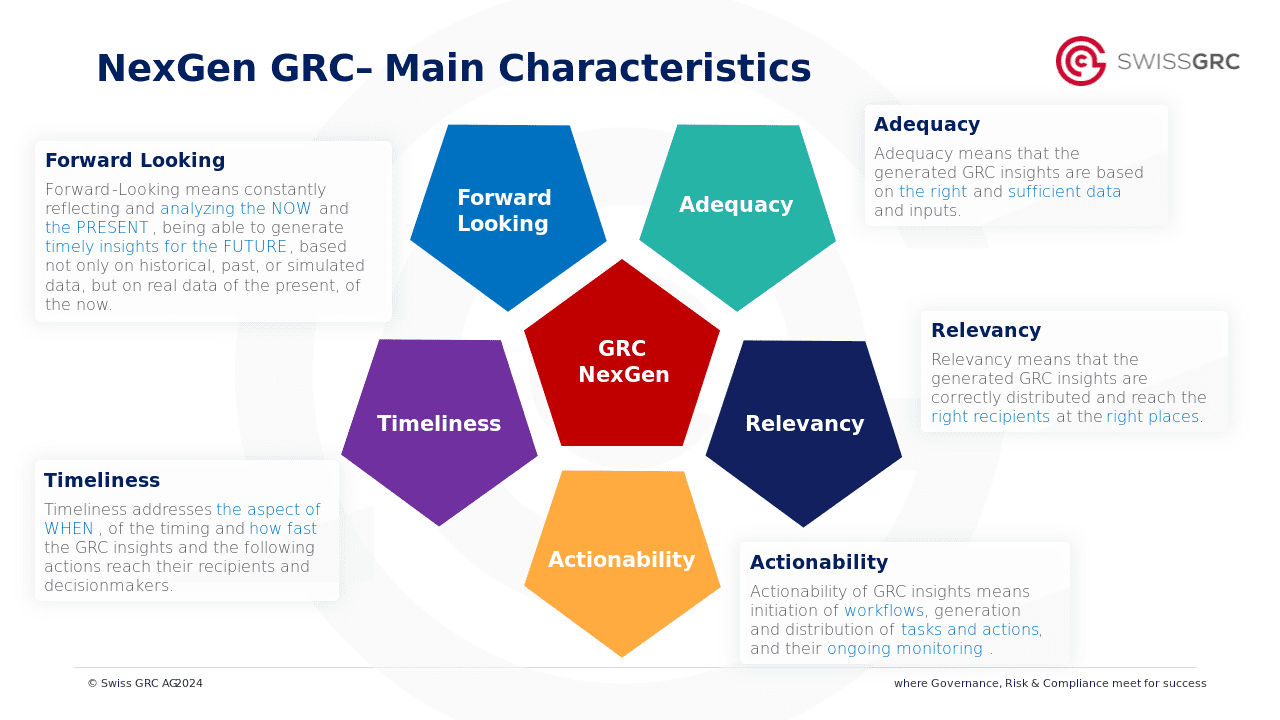

The GRC Evolution driven by its natively inherited privilege

When hearing the acronym GRC, practitioners familiar with the term, which stands for Governance Risk and Compliance, intuitively associate a heavy regulatory burden, formal and rather cumbersome compliance procedures and deadlines, painful internal and external audits, and huge costs.

The EU’s AI Dilemma: Innovation or Over-Regulation?

The tension between innovation and regulation presents the EU with a difficult task. It must find a way that both exploits the enormous potential of AI and protects the safety and rights of its citizens. The future of AI in Europe depends on how well this balance is achieved.

Review: Webinar on the new Information Security Act

With the Swiss Federal Council’s decision to bring the Information Security Act (ISG) and the corresponding ordinance into force on January 1, 2024, Switzerland is sending a clear signal for increased information security and cyber security. In this context, Swiss GRC organized a webinar.

Federal Council brings ISG and ordinance law into force on January 1, 2024

The Federal Council has set the date for the new Information Security Act (ISG) to enter into force on January 1, 2024. This decision marks an important milestone in protecting information and strengthening cyber security in Switzerland.

All Blog posts

When hearing the acronym GRC, practitioners familiar with the term, which stands for Governance Risk and Compliance, intuitively associate a heavy regulatory burden, formal and rather cumbersome compliance procedures and deadlines, painful internal and external audits, and huge costs.

The tension between innovation and regulation presents the EU with a difficult task. It must find a way that both exploits the enormous potential of AI and protects the safety and rights of its citizens. The future of AI in Europe depends on how well this balance is achieved.

With the Swiss Federal Council's decision to bring the Information Security Act (ISG) and the corresponding ordinance into force on January 1, 2024, Switzerland is sending a clear signal for increased information security and cyber security. In this context, Swiss GRC organized a webinar.

GRC TOOLBOX

Start your GRC journey with us

Test all functions of the GRC Toolbox and convince yourself of the easy-to-use software for your GRC management.

Mirko Hegi, GRC Expert, PostFinance AG

Right from the start, the cooperation was at eye level and we understood each other, not only on a professional but also on a human level.

DE

DE